“No Way,” you say. “Way,” I say!

Mimetic desire in the world of business aviation always goes wrong.

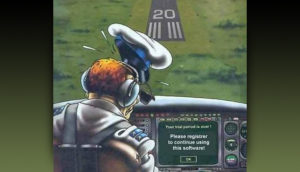

It goes wrong as it is almost entirely based on the Dunning Kruger effect, the paradox where you do not know what you do not know. And when you do not know what you do not know, how do you know if you are doing it right or wrong? The knowledge you need to make the right decision is exactly the knowledge you do not have.

Having a desire to be known and accepted in the world of business aviation is not enough to be successful in aviation. You need real knowledge and real experience, not to mention real know-how to function, and more appropriately, to be profitable in the highly complex world of business aviation.

Recently, we are not only seeing more and more Dunning Kruger’s entering the world of business aviation, but more and more of them have strong mimetic desires.

Mimetic desires stipulate that we frame our desires around the wants of others; that we’re always looking to models of desire.

In the business aviation world, pilots fly and are respected for their skills. Maintenance people do maintenance and are respected for their abilities, but the trust fund wanabe’s that buy aviation companies or have their daddies buy them an aviation company, all come from a deep-seated mimetic need to be recognized as the captains of the aviation industry, and they are a complete joke.

These TFBs (Trust Fund Babies) have zero idea how aviation works, but they do not care. They still have that mimetic desire that demands recognition as leaders of something they have no idea of what it is or how it works. So, they always fail.

This new breed of TFBs comes with mimetic desires that started to appear on the scene several years ago. Since they have no idea how to make money with or from airplanes, they are adopting various angles that have nothing to do with aviation except that airplanes are central to these plans (some would say schemes).

This new breed of TFBs comes with mimetic desires that started to appear on the scene several years ago. Since they have no idea how to make money with or from airplanes, they are adopting various angles that have nothing to do with aviation except that airplanes are central to these plans (some would say schemes).

Yes, those beautiful shinny things that cost a lot of money provide a needed function for other TFBs that have a mimetic need to travel in style, therefore aviation TFBs attract other TFBs to play with the shiny objects.

So, let’s now look at the playing field and the components of the game.

On one side of the equation, we have TFBs with the money to acquire the required shiny objects to provide transportation for other TFBs. Then we have other TFBs that are service providers that provide service to the TFBs that own aircraft that provide transportation to the other TFB’ers. Get it?

This is the fertile ground for the “me too” followers and the wannabes.

TFB’s that own the business aviation companies have been following each other around making the same mistakes, but now they are playing Three Card Monty.

As more and more information comes out about Cards and Piggybacking and time shares (fractional) it becomes more and more obvious that wannabes are really nothing more than Dunning Krugers with mimetic desires to be recognized as something that are surely not; leaders of the aviation community.

A representative case in point; in 1995 as the price of new aircraft reached $15 million each, and new aircraft sales dropped substantially. At that point someone from the time-share community saw an opportunity in aviation and “fractional” was born. The idea was to spread the $15 million cost (at that time) over 4 owners making each owner in for under $4 million. And that worked for a day. Then the obvious problem kicked in because when you put four owners on anything, you are either going to have to mirror the product (fleet in this case) or tick off customers by being unable to provide the services that were promised. So technically, time-sharing airplanes (fractional) never worked. But instead of finding a solution to the base problem, they simply added as many as 32-time-share owners on one airplane! That is one more shareholder than there are days in the month. Did anyone ever really think that would work? That led to insane dead head costs which are passed along to the time share owners making their per hour costs 2 to 4 times more as a share owner than owning one’s own airplane!

And jet airplanes have no chronological age like people do.

The FAA’s airframe life is based on FAR 25 airframe hours, which is 100,000 hours.

So, a used aircraft at 5% of the original cost, is just has safe, if not safer*, than a new one. Basically, they are the same airframes compared to new ones that cost more than $50M-$60M, even $80 million more than the 20 year old one. If people tell me that they are “too important to fly on an older aircraft,” well, Airforce One was built in 1989 (both of them), and a 20-year old aircraft that has been flying 300 hours a year has 6,000 hours on it or still has 94% of its life in front of it.

they are the same airframes compared to new ones that cost more than $50M-$60M, even $80 million more than the 20 year old one. If people tell me that they are “too important to fly on an older aircraft,” well, Airforce One was built in 1989 (both of them), and a 20-year old aircraft that has been flying 300 hours a year has 6,000 hours on it or still has 94% of its life in front of it.

So, if you like spending 10 times as much for the same thing, then time-sharing is for you.

Now we have “Cards”. Ideally you purchase a card and fly when you want to, but recently various card companies are having issues with them as they are not doing what they say. Recently one such company is in the news as the SEC exposed that it raised over $800M selling cards, and has only $130M to show for it.

Then there are shares, another name for fractional.

How about Piggyback charter? Now there’s a winner! The owner provides the plane, the fuel and all the operating costs including the booze in the bar. Did I say all the operating expenses while the operator makes 15% per hour off the top? I can show anyone on my analyzer how the owner will lose hundreds of thousands of dollars annually, while the operator skates away with no costs, just all the profits. Would those enrolling in Piggyback admit to how Dunning Kruger is alive and well in their decision to go that route?

Then there are empty legs flights, and on and on it goes.

So, sure. A few people make a lot of money just like Bernie did, but then he was not in the aviation business. Bernie was in financial services. Today, we do not even have to imagine what that might look like. All we must do is look at the businesses…it is all there in front of anyone who wants to take the time to look.

But none of this need be. I have developed the cure for the sting where everyone makes money; primarily the aircraft owners, then the operators, while still guaranteeing the charter brokers their commissions.

There has never been anything like this before where everyone in the pattern makes money. This program checks all the boxes for success. It is based on the true realities of aviation, and provides the one ingredient that has always been missing in business aviation. “Reality” serviced by actual aviation experts, not mimetic Wannabe or Dunning Kruger’s that do not know what they do not know.

Nothing tricky. No false claims to customers. No FAA, no SEC. Just real opportunities for all concerned.

I understand that an actual working system that is profitable in business aviation is unheard of, but it can be done –a system based on real working and operational truths.

I know that the truth in aviation is something new, but it is needed, and it is not just doing something new that will work. Oddly enough, I am a high time pilot, I have created and co-founded two major brands in the aviation industry, and this will be by far the biggest and most profitable disruptor ever. In fact, it will completely change the entire business aviation paradigm for good.

It will also change the standing of any investor who partners with me… for good.

*New airplanes, especially new models with no track record of reliability, often have recalls and issues that appear in the course of their operation (that older models which have been tried and true) do not.

Assuming you are in the aviation business or want to be, only profitable please contact me at rick.eriksen@cox.net

Thank you for your time.